By Rod Bristow, CEO of Breakthrough Victoria

In venture capital, the J-curve is a familiar concept: early investments often show negative returns before compounding into exponential growth. For Breakthrough Victoria (BV), the 2024/25 financial year marks a critical point—where foundational work is translating into measurable impact across Victoria’s innovation ecosystem and the Victorian economy.

Since inception, BV has grown to $480.7 million in committed capital and 77 investment approvals, encompassing direct investment into companies, funds, co-investment with universities, and fellowships. BV is more than a traditional VC fund - we are an ecosystem builder that helps companies through the ‘valley of death’ with capital and access to new customers and capability.

This year, BV achieved an operating profit of $200,000, reflecting ongoing improvements in operational efficiency.

A Multiplier Effect in Motion

BV’s investments have now leveraged more than $1.3 billion in additional capital, achieving a 1:3.21 ratio—a powerful signal of market confidence and co-investor appetite. On average, each investment attracts 7.7 co-investors, underscoring BV’s role as a magnet for private capital. BV has crowded in investment to Victoria from all over Australia and worldwide - having co-invested with investors from 16 countries.

This isn’t just about money—it’s about momentum. During the last financial year BV evaluated 436 investment opportunities, demonstrating both deal flow strength and rigorous selection. The result? A portfolio that’s not only growing, but outperforming.

The year has seen success, as a number of portfolio companies reach major milestones in their commercialisation journey.

Navi Medical and Atmo Bioscienes both received 501k clearance from the FDA.

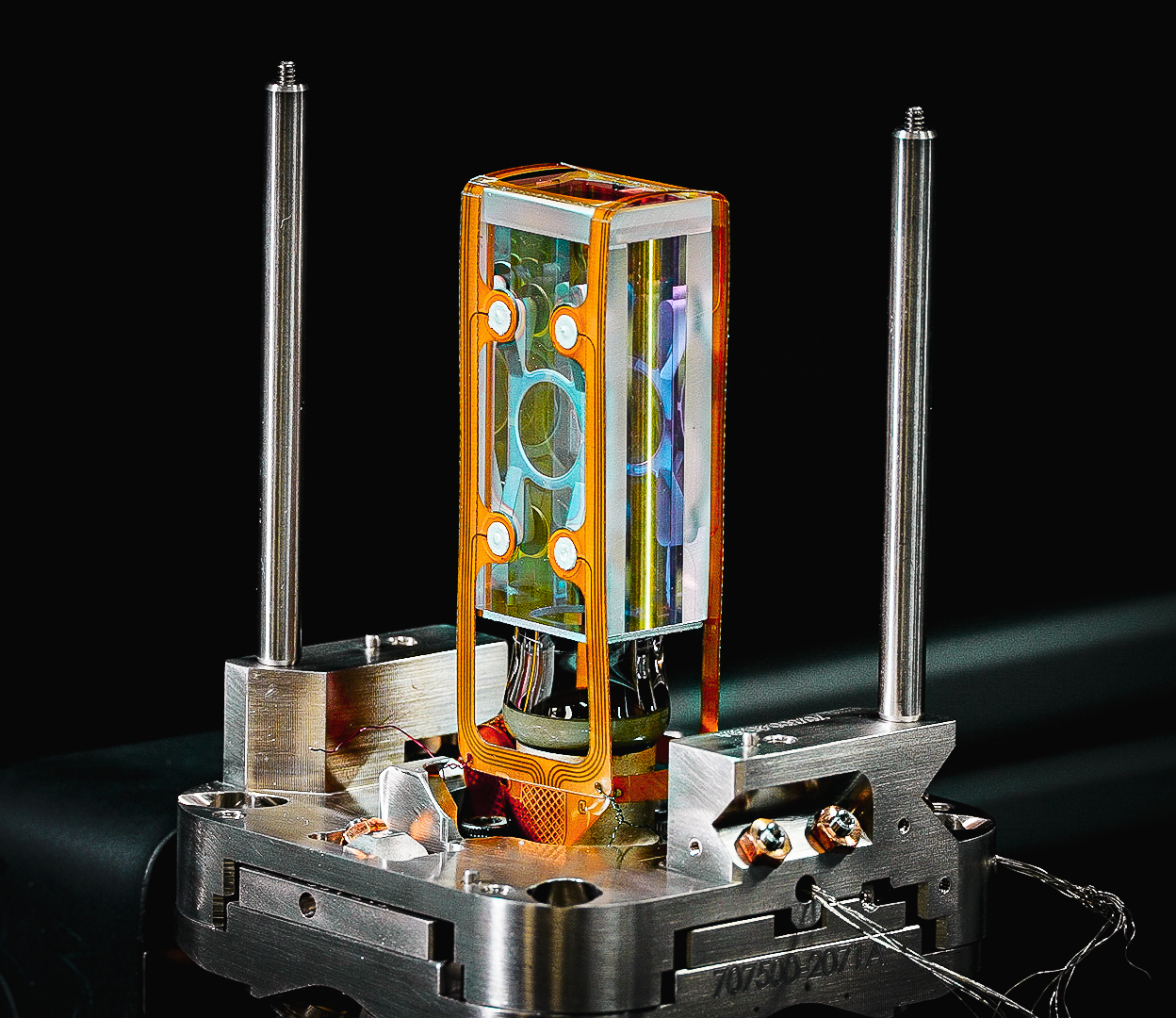

Quantum Brilliance installed three of its quantum processor units (QPUs) at Oak Ridge National Laboratory (ORNL). The installation will be used to "explore how parallelized QPUs can enhance high-performance computing, much like GPUs have done for classical workloads".

Xefcolaunched their XReflex® range of textiles - an innovative radiant barrier technology that enhances thermal retention by reducing heat loss via infrared radiation. "Depending on material type and configuration, it can deliver up to 60% increase in heat retention".

Bygen announced the completion of an independent Life Cycle Assessment (LCA) with Minviro - conducted under ISO 14040, 14044, and 14067 standards. The study confirmed that Bygen’s activation technology delivers a "dramatically lower carbon footprint compared to conventional activated carbon production."

Infleqtion began preparing to list on a US stock exchange via a SPAC at a valuation of US$1.8 billion (A$2.7 billion)

Amber secured a $10m investment from E.ON Next in the UK and Virescent Ventures here at home, to bring their technology to households worldwide. The backing is a strong signal that Australian-built solutions can play a major role in shaping the future of energy globally - helping households cut costs, integrate solar, batteries and EVs, and support a cleaner, more flexible grid.

Confluxhas engineered a lightweight, high-performance heat exchanger tailored to the extreme requirements of megawatt-class aerospace fuel cell systems with its AIRBUS ZEROe project.

Aravaxcompleted recruitment for its Phase 2 trial, with results of its peanut allergy trial expected in mid-2026.

Raygen’s proposed Yadnarie renewable energy facility in South Australia was acquired by AGL from Photon Energy. The acquisition is a major milestone in the commercial deployment of RayGen’s pioneering solar and thermal hydro long duration storage technology.

Backing Victoria’s Future

The portfolio is deeply rooted in Victoria’s innovation DNA:

- 83% are exporting or planning to export*

- 79 patents have been filed*

These are not vanity metrics—they’re indicators of real-world traction, global competitiveness, and long-term value creation to deliver economic benefit for Victoria.

Dominating the VC Landscape

BV’s presence in the venture ecosystem is now undeniable:

- 88% of early-stage VC in Victoria is backed by BV**

- 76% of venture-stage VC in Victoria is backed by BV**

This level of market coverage positions BV not just as a participant, but as a strategic anchor in Victoria’s startup economy.

Talent

Beyond capital, BV is investing in people. With 59 applicants to our Fellowship Program and 3 Fellows awarded, the organisation is cultivating the next generation of innovation leaders—embedding capability into the ecosystem it funds.

Looking Ahead: The J-Curve Ascent

BV’s projected $5.3 billion economic impact by 2035**, reflects the long-term payoff of early-stage risk. These projections aren’t speculative—they’re grounded in portfolio performance, co-investment strength, and sectoral alignment.

As BV transitions from foundation to acceleration, it’s clear the organisation is entering the steep upward slope of the J-curve. The groundwork has been laid. The returns—economic, social, and strategic—are beginning to compound.

Breakthrough Victoria isn’t just funding innovation. It’s engineering the future of Victoria’s economy.

*As at Jan 2024.

**EY-Parthenon, calendar year 2024