VC at an Inflection Point: Why Patient Capital Like Breakthrough Victoria’s is Critical in Today’s Climate

Rod Bristow, Breakthrough Victoria CEO

The venture capital industry is at an inflection point.

As highlighted in Saastr’s recent analysis , only 37 per cent of 2019-vintage VC funds have returned capital to their investors.

This stark reality reflects the challenges that many generalist VC funds face today: compressed valuations, longer paths to exit, and heightened scrutiny from limited partners eager for liquidity. In this environment, alternative asset classes have become far more attractive for LPs, making fundraising for new funds markedly harder. It’s clear that the 2021 boom — characterised by substantial capital chasing fast exits — no longer applies.

At Breakthrough Victoria, our mandate is different — and that difference has never been more important. As a government-backed investor tasked with transforming the Victorian economy by investing in and supporting successful IP and research commercialisation, we are built for long time horizons. Our role is to catalyse deep tech, life sciences, advanced manufacturing, and other innovation sectors that form the backbone of future industries — precisely the areas where traditional VC is now pulling back.

Where others see risk, we see opportunity. Deep tech and IP-rich ventures often take a decade or more to reach scale. These opportunities need patient capital aligned with realistic development timelines and national interest objectives. Breakthrough Victoria fills this gap — de-risking breakthrough technologies, crowding in private capital, and helping convert world-class research into jobs, exports, and sovereign capability for Victoria.

The data behind VC’s current fundraising challenges should remind us all that the future of innovation finance cannot rely solely on fast-cycle, generalist venture funds. It requires a diversified capital stack — one that includes dedicated, mission-driven investors like Breakthrough Victoria, willing to stay the course even when market cycles turn.

Global venture markets have rapidly recalibrated. At Breakthrough Victoria, we will continue to do what we were set up to do: back the bold ideas that will shape Victoria’s economic future, provide stability through cycles, and ensure that transformative technologies don’t just get invented here — they get built and scaled here.

About the author: Rod has 30 years’ experience encompassing the stockbroking, asset management, wealth management, agribusiness and not-for-profit sectors.

His previous roles include CEO of Sydney and Singapore-based VC firm Investible, ICEO of ASX-listed Clime Investment Management Limited, MD of Infocus Wealth Management Ltd, CEO of environmental NGO Greening Australia and Chief Operating Officer and alternate MD of Australia’s largest retail stockbroker, CommSec. He also cofounded a business in the environmental management and carbon offsets space, and his career has been defined by a deep commitment to the intersection of capital and impact.

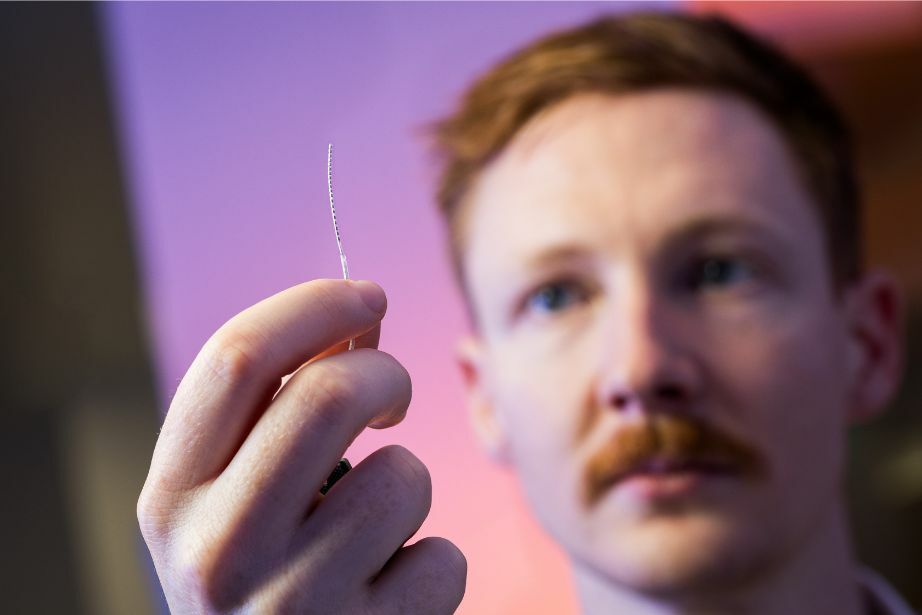

Header Image: BV Portfolio company Neo-Bionica